13 Must-Have Real Estate Investment Tools

Real estate investment tools are used by residential and commercial real estate investors to help analyse property to see whether or not it’s worth investing in. Here is a list of financial tools, apps, and software that you can use to manage properties and investments more effectively.

Financial real estate investment tools and methods

These financial tools and methods for real estate investment will help protect your property investment and capital, and assist you in making informed investment decisions.

- Cash flow pro forma.1 Cash flow projection is the first thing investors look at when considering any potential real estate investment property. A real estate pro forma allows you to evaluate the overall profitability of a property, taking into account the revenue, potential gross profit, effective gross profit, operating expenses, total expenses, net operating income, and adjusted net operating income.

- Discounted cash flow method (DCF). A DCF is a method of valuing all financial assets, including commercial real estate. It works on this basic principle: money has more value right now than it will in the future.2 Similarly, the value of an asset is essentially the value of all future cash flows that are discounted for risk. This method endeavours to calculate the viability of a potential investment by working out what the projected future income or cash flow will be, and then discounting that cash flow to reach an estimated current value of the investment.3

The following factors should be included for real estate investments: initial cost, interest rate costs, holding period, additional year-by-year costs, projected cash flows, and the projected amount of profit the owner hopes to receive once the property is sold. Forecasting is not an exact science, and DCF analysis is the most holistic approach to evaluate all of the risk factors that are considered in a real estate investment.

- Net present value rule.4 This is used to calculate the present value of your net future cash flows from investments in real estate property. To calculate the net present value of future cash flows, discount all future cash flows by the desired rate of return, and then deduct that value from the initial cash or capital investment amount. The rule states that investors should only invest in a project if the net present value is positive.

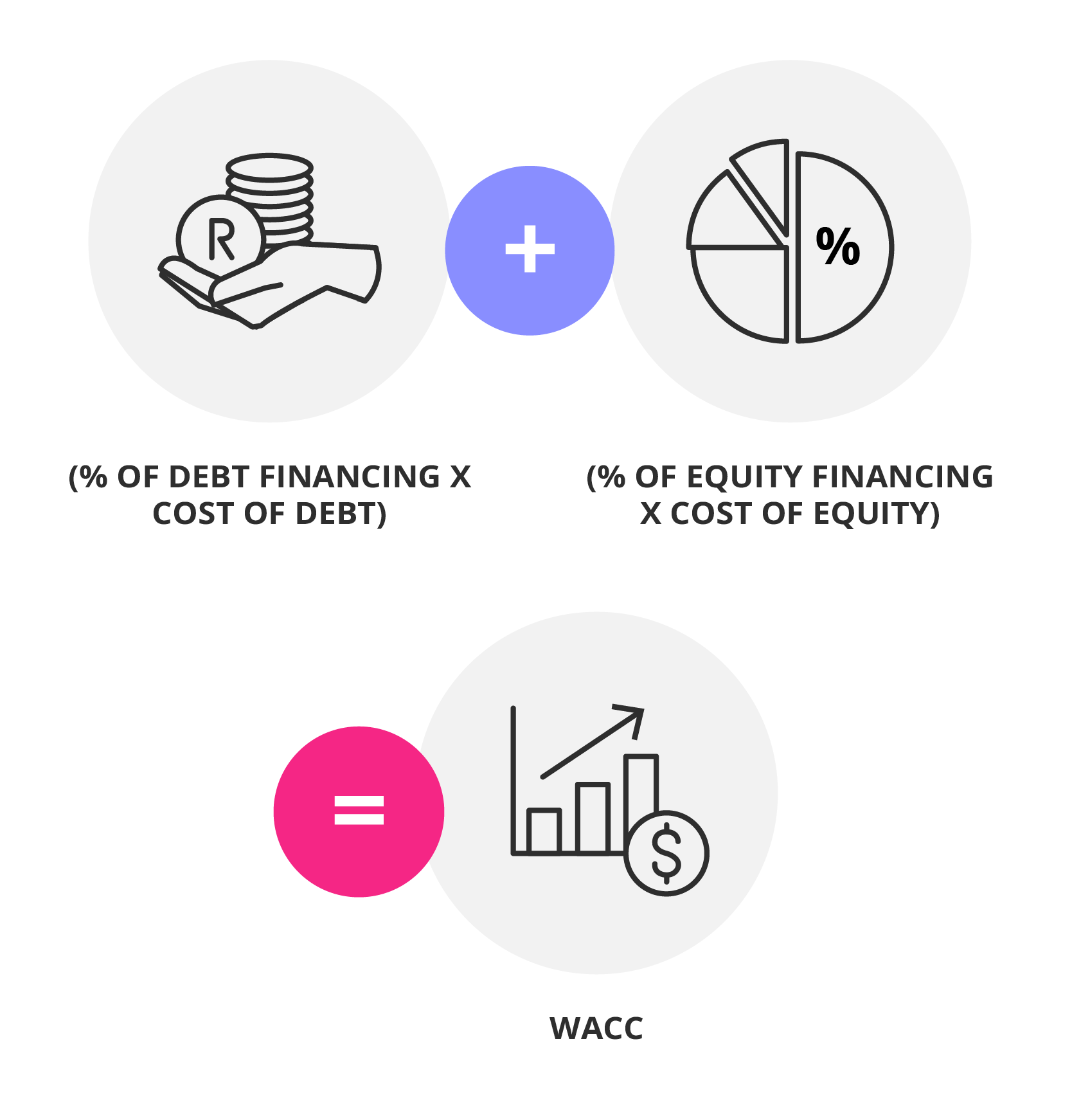

- WACC formula.5 The weighted average cost of capital (WACC) quantifies debt risk. It’s the weighted average of all financial loan sources used to fund an investment, or the cost of the investment’s capital – both debt and equity. The WACC formula is:

The WACC formula can be used to determine the debt risk of investments you’re considering. You should be cautious of deals that have loan-to-value ratios above 75 per cent.

- Supply and demand.6 Real estate value depends on the law of supply and demand: when the demand for property is high but supply is low, property prices increase. Conversely, when the supply of properties exceeds the market demand, prices tend to fall.

- Benchmarking.7 This is the standard of measurement used by investors to evaluate whether or not a property is worth investing in. An investor will identify the real estate property’s financial characteristics, each of which represents a way in which it can earn income for its owner, and then set their ideal value for each indicator.

The most commonly used benchmark indicators include cash-on-cash return (the difference between the deposit and the yearly income generated from rental income), debt coverage ratio (if the rent will cover the bond), net cash flow (the amount of income remaining after the costs of regular maintenance), and loan-to-value ratio (the difference between the bond’s outstanding balance and property’s current market value, expressed as a percentage).

Software and apps for real estate investment

Successful real estate investors pair technology with their property expertise in order to find the best new property opportunities. With the property investment market getting more crowded, the right technology will give you the advantage you need.

- DealMachine.8 This app, for American properties only, allows you to buy properties nobody else knows are for sale, thus eliminating potential bidding wars between investors. Simply take a picture of any house, and the app immediately provides owner information, and then sends the picture to the owner in the mail along with your offer to purchase. The app also does automatic follow-ups until they respond.

- Online property finders. Property sites such as Knight Frank will give you access to property feature details, profiles that include area demographics, commuter and occupancy statistics, local weather patterns, school ratings, and more.

- Point2 Homes.9 This online real estate tool is essential for investors. It covers nearly 70 countries and allows you to search for various property types for sale, as well as connect with professionals who can provide valuable local information to help you make a more informed investment decision.

- Property Capsule.10 This platform offers cloud-based technology that allows you to move all your investment data off paper and onto a suite of applications for web, mobile, tablet, print, desktop, kiosk, email, APIs, and more. Features include automated marketing materials, centralised management of information, online dealmaking, data-driven interactive maps, and portfolio review tools.

- Rent Manager.11 This mobile-friendly software can handle properties of any size, and is a flexible and easy-to-use property management platform. It comes with an asset management database, integrated accounting, contact management, and work ordering capabilities. It also features marketing solutions and allows you to track, manage and resolve service issues, as well as track finances by downloading detailed reports. If you want to find new tenants or buyers for a property, you can create a professional and interactive website that’s integrated with Rent Manager.

Other real estate investment tools

Real estate investing is a competitive business, you’ll have an added advantage if you have these additional tools.

- Education.12 While a degree in real estate investment might not be needed, educating yourself is still the best tool you can have in order to succeed in real estate investing. Read books and articles, listen to podcasts, invest in online learning, and talk to other investors.

- Contacts.13 The more people you know in this industry, the better. Network with real estate professionals from all sectors, such as property agents, building contractors, tenants, and other investors. Knowing the right people will expedite the initial investment process. It’ll also ensure that the skills you lack are complemented by those in your network.

The above real estate investment tools will assist you in making better investment decisions and improving your chances of success in the industry. From searching for properties to providing important analytics, these real estate tools will serve you well in your investment journey.

- 1 Esbaitah, W. (2017). ‘How pro forma works in real estate investments’. Retrieved from BiggerPockets.

- 2 Welk, D. (Feb, 2018). How to use discounted cash flow analysis in commercial real estate’. Retrieved from Origin Investments.

- 3 Maverick, J. (Jun, 2019). ‘How to use DCF for real estate valuation’. Retrieved from Investopedia.

- 4 Hamed, E. (Dec, 2017). ‘How to use the net present value in real estate investing calculations?’. Retrieved from Mashvisor.

- 5 Scherer, D. (Mar, 2018). ‘Using WACC to quantify debt risk in real estate investments’. Retrieved from Origin Investments.

- 6 Hall, M. (Jul, 2019). ‘How does supply and demand affect the housing market?’. Retrieved from Investopedia.

- 7 (Nd). ‘What is real estate benchmarking?’. Retrieved from Financial Web. Accessed 4 June 2019.

- 8 (Nd). ‘DealMachine’. Retrieved from DealMachine. Accessed 4 June 2019.

- 9 (Nd). ‘Point2 Homes’. Retrieved from Point2 Homes. Accessed 23 February 2020.

- 10 (Nd). ‘Property Capsule’. Retrieved from Property Capsule. Accessed 4 June 2019.

- 11 (Nd). ‘Rent Manager’. Retrieved from Rent Manager. Accessed 4 June 2019.

- 12 Andreevska, D. (Mar, 2018). ‘8 must-have real estate investment tools’. Retrieved from Mashvisor.

- 13 Abualzolof, P. (2016). ‘6 must-have real estate investment tools’. Retrieved from BiggerPockets.