The Millennial Investor: A Guide To Empowered Investing In Uncertain Times

In 2008, the investment world was turned upside down. The consequences of the global financial crisis leading to the recession have now resulted in low-interest rates, low growth and even lower returns.

The generation who graduated during this credit crisis?

Millennials – many of whom have seen their parents or grandparents lose all of their hard-earned retirement savings in the stock market.

“The stock market crash, and doom and gloom has scared some of us”, says Shannon Lee Simmons, a 30-year-old Toronto-based certified financial planner and founder of the New School of Finance.

“We’ve seen some scary markets in our adult life and I think it’s making us more risk-averse.”1

But now is the most important time for Millennials to empower themselves to confidently invest.

Older Millennials are entering their highest earning years and on top of that, $30 trillion in assets is expected to be passed from the Baby Boomer generation to Millennials in the coming years.2

Unfortunately, many Millennials will still be in the midst of paying off their student debt; while a lack of knowledge in others has made them think they have a lot of time before they need to worry about retirement.

Three facts you need to know about Millennials and investing

- A recent Wells Fargo survey stated even though 80% of Millennials knew they should be saving money, only 55% were actually doing it.3

- A study conducted by Facebook IQ in 2016 titled Millennials + Money: The Unfiltered Journey found Millennials crowdsource financial advice, and are a key part of the sharing generation.4

- They prefer to be savers rather than investors, a trend which is a result of “access to lightning-fast technology innovation, and the dramatic economic and market volatility that constrained job prospects and earning abilities, as well as disrupted their parents’ real estate values, investment portfolios and retirement savings.”5

The way people currently invest doesn’t appeal to this generation.

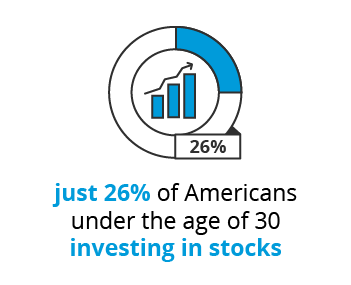

They lack trust in financial institutions and the investment industry at large, rather trusting their own knowledge or knowledge of their online networks; they’re disillusioned with the idea of investing and are very conservative in their approach to stock markets with just 26% of Americans under the age of 30 investing in stocks, according to a Bankrate Money Pulse survey.6

How to approach the investment industry as a Millennial

You’re a part of the biggest generation in history, and it’s because of this you hold the potential to have as much, if not a greater, influence in shaping economic trends as your predecessor generation had.

But you don’t have to look like the investor of the past.

You can be the face of the new-age investor, one who is financially-savvy and engages in smart investing, looking to alternative options for investing money rather than settling for traditional methods.

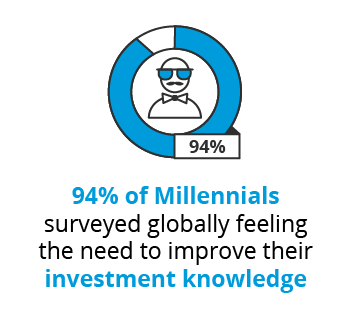

Your first step is to educate yourself. A recent Schroders Global Investors Study proved the younger generation of investors is in great need of financial advice with 94% of Millennials surveyed globally feeling the need to improve their investment knowledge.7

The economy may always be uncertain, but that doesn’t mean you should be. Be proactive with your wealth. If you don’t trust a faceless man in a big firm managing your finances, take ownership of your own financial portfolio.

Equip yourself with the necessary skills to understand the financial markets; the different investment options available to you; and how to make the best investment decisions. From something as simple as learning how to budget and track your expenses to investigating new financial technologies such as cryptocurrencies, you will feel, according to investFeed CTO Andrew Freedman, “empowered by the ability to participate in markets without traditional third-party interference”

Are you ready to overcome your investing fears and shape a new financial future for yourself?

Study the UCT Investment Management online short course today

1The Globe and Mail

2Forbes

3Wells Fargo

4Facebook IQ

5MoneyWeb

6Bankrate

7Schroders