How to Become a Fintech Entrepreneur

Over the years, financial technology innovation has moved from a nascent disruptive tech to an established means of shaping both your career ambitions and the profile of an entire enterprise.

Although traditional finance incumbents were once threatened by fintech investments, recent data from 2020 demonstrates a move from competition to coalition, with investments projected to reach a value of $310 billion by 2022.1

These fintech partnerships aren’t generally brokered to raise capital immediately, but to append other benefits, such as extending your reach to customers, or to overcoming licensing issues. Some fintech startups will create an innovative new platform before seeking a partnership with an established provider. Others might partner with farmers or large social organizations to reach customers in difficult-to-access regions.

All of this shows that the time has never been better to start your career as a fintech entrepreneur.

But fintech development involves more than just providing funding for innovation. If you’re a fintech entrepreneur keen to distinguish yourself, you’ll need to consider how to execute a business strategy in a field that is both competitive and highly regulated.

This is what you need to know to become a fintech entrepreneur:

What is fintech?

Fintech is used to describe new technology that improves and automates the delivery and use of financial services. At its core, fintech is utilized to help companies, business owners, and consumers better manage their financial operations, processes, and lives by utilizing specialized software and algorithms.

Fintech startups include digital challenger banks like Starling or ClearBank, which offer alternatives to traditional banks; mobile-focused health insurance products like Oscar and Clover; and digital currency exchanges like Coinbase or Luno.2

What are a fintech entrepreneur’s responsibilities and concerns?

As a fintech entrepreneur, you’ll have the same responsibilities as a traditional entrepreneur, while also navigating the complex worlds of financial services and technology. In addition, it’ll also be essential to establish a trusted and secure tech product that can withstand cyberattacks and hacks.

As a fintech entrepreneur, you need to be aware of the following risks.3

A lack of industry knowledge

Recognizing your market and industry ensures you’re not operating in a vacuum, that is, it’s not always about disrupting the entire market. Sometimes, it’s simply about serving your customers to the best of your abilities.

Innovation without improvement

The focus of any new application should be to address your customers’ pain points rather than simply doing something in a whole new way because you can.

Overlooking financial regulations

Finance is a heavily regulated sector and creating disruption through innovation brings its own set of challenges. Inform yourself about the legislation and don’t go into the industry ignorant and without the necessary legal knowledge or support.

Ignoring customer onboarding

As fintech development accelerates, so does the number of potential customers. You’ll need to ensure you sufficiently guide your users through a new product.

Overcomplicating your product

Keep your focus tight – aim to overcome one or two key challenges, with an intuitive and user-friendly product.

A negligible sales and marketing strategy

You need to explain to customers what drives your business and what you were thinking at key stages of production. Show that customer-centricity is something you care deeply about.

Inability to adapt

Listen to early users’ feedback and adapt your product iteratively to keep your product current.

Cyber risk and customer trust

Cyberattacks and data breaches are widespread, and the type of information fintech companies hold makes them prime targets. Increased instances of digital fraud, peer-to-peer lending platform collapses, and irresponsible digital microcredit lending practices illustrate these risks.

While some of these risks are new, many are new manifestations of existing challenges. They are generated from the underlying technology enabling fintech, but also from new business models, product features, and provider types.

Along with a healthy awareness of the risks, a fintech entrepreneur can gain expertise in the following key areas of knowledge to realize business goals and achieve success:

The critical skills you need

Entrepreneurship

- Generate, identify, and capitalize on new business opportunities

- Prioritize navigating the legal environment when starting a business

- Develop an effective and bespoke marketing plan for your organization

Fintech

- Draft, strategize, and develop disruptive fintech innovations with tools and techniques

- Anticipate the effect that new regulations will have on future commerce products

- Build your knowledge of the future of finance, and possible future trends in fintech

Cybersecurity

- Assess the vulnerabilities of an organization’s critical business systems, networks, and data

- Distinguish the legal and compliance risks for an organization or sector

- Propose an incident response plan for a cyberattack and develop a cyber risk mitigation strategy

What career path does a fintech entrepreneur follow?

Depending on the sector in which your fintech product or service plays, your career path can follow numerous roads.

In recent years, companies have realized the value of partnering with fintech firms to leverage innovation and, in particular, deliver an enhanced customer experience. The result is a unique alchemy between technology, progressive startups, and top established companies. For instance, the Collison brothers founded Stripe with the assistance of Y Combinator, a company that provides seed funding for startups, with the aim of later introducing additional investors once the startups are through the first stage.

Such collaborative business journeys reveal how exciting, and nontraditional, a fintech career path can be. In the space of a year, a startup can receive funding that takes a company – and career – from entry-level to industry competitor.

What is the potential salary for a fintech entrepreneur?

As the founder or starting member of a fintech startup, your salary is based entirely on the success of your company.

To give you a sense of the top earning salaries, here is what four CEOs of fintech startups are currently worth:

- Baiju Bhatt (Robinhood): $1.8 billion4

- Peter Thiel (PayPal): $3.4 billion5

- Patrick Collison (Stripe): $9.5 billion6

- Elon Musk (SpaceX; Tesla, Inc.): $297 billion7

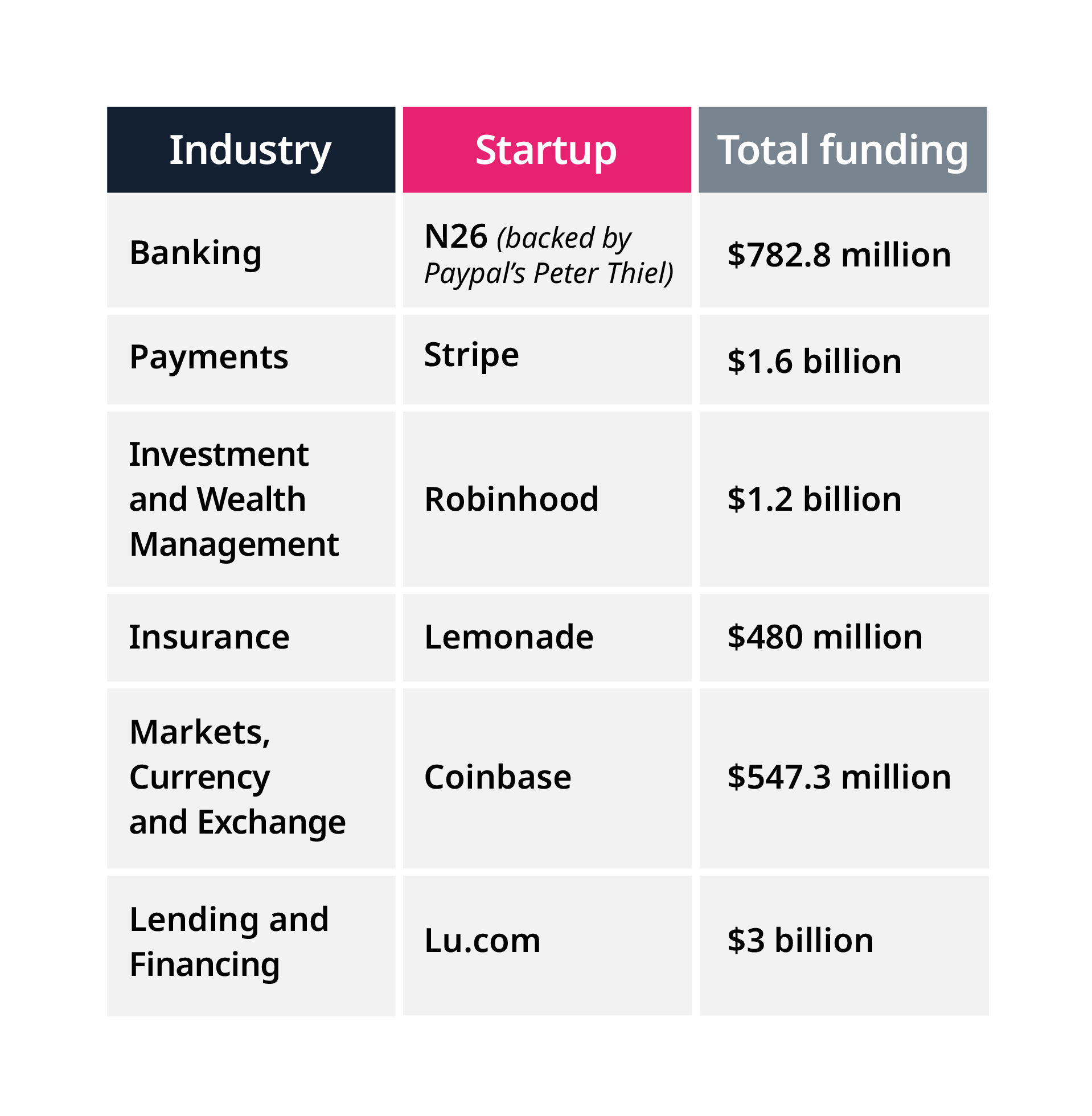

Take a look at the leading fintech startups worldwide in terms of market value in 2021, and the value of investment for each.8

What are the education requirements for a fintech entrepreneur?

Depending on the industry in which you want to start your fintech company or the type of product you wish to develop, you could require anything from a college certificate or bachelor’s degree to a doctorate or multiple short-course certifications.

For example, Kenneth Lin, founder and CEO of credit score monitoring company Credit Karma, graduated from Boston University with a bachelor’s degree in economics and mathematics and worked in the credit industry for a decade before starting his now multi-billion-dollar fintech company.9

Patrick Collison, founder of Stripe, dropped out of MIT before setting up his first fintech company – which later merged with another project to become auction software company Auctomatic, selling for $5 million one year later.10

One way to set yourself up for success is to take the six-week Harvard VPAL FinTech online short course, designed to provide a comprehensive understanding of the new financial landscape. The course enables you to discern which fintech innovations will be key to scaling your future business ventures.

Prepare for the future of finance

Browse the portfolio of online courses and take the first step to becoming a fintech entrepreneur.

- 1 (Nov, 2021). ‘81 Key Fintech Statistics 2020/2021: Market Share & Data Analysis’. Retrieved from Finances Online.

- 2 Kagan, J. (Aug, 2020). ‘Financial technology – fintech’. Retrieved from Investopedia.

- 3 Ściślak, J. (Jan, 2021). ‘Top 10 reasons why fintech startups fail’. Retrieved from Code & Pepper.

- 4 (Jan, 2022). ‘Baiju Bhatt’. Retrieved from Forbes.

- 5 (Jan, 2022). ‘Peter Thiel’. Retrieved from Forbes.

- 6 (Jan, 2022). ‘Patrick Collison’. Retrieved from Forbes.

- 7 (Jan, 2022). ‘Elon Musk’. Retrieved from Forbes.

- 8 (Aug, 2021). ‘These are the top fintech companies and startups in 2021’. Retrieved from Insider Intelligence.

- 9 (2021). ‘About us’. Retrieved from Credit Karma.

- 10 (Feb, 2021). ‘How two brothers from rural Ireland built a $115bn payments giant’. Retrieved from The Telegraph.